U.S. Tariffs After August 1: Who’s Hit and What It Means for Global Trade

Time to read: 3 minutes

As of August 2025, the U.S. has implemented sweeping new tariffs on imports from more than 80 countries, following the expiration of multiple trade negotiation deadlines.

The updated tariffs mean importers must now pay significantly higher duties on a wide range of goods—from industrial metals and electronics to clothing and consumer products. Businesses across manufacturing, retail, and logistics are already adjusting pricing models to offset the increased costs—many of which are likely to be passed on to end consumers.

The new rates officially take effect on August 7, with certain exceptions:

- Canada’s 35% tariff began on August 1, though many goods remain exempt under the USMCA.

- Brazil faces one of the steepest hikes, with a flat 50% tariff on most categories.

- Mexico has secured a temporary reprieve, maintaining its current rates for 90 more days.

- U.S.–China tariffs remain under review, with both sides agreeing to delay escalation until August 12.

This article breaks down the current tariff structure by country and industry, highlighting the latest trade deals, exemptions, and what businesses should watch next.

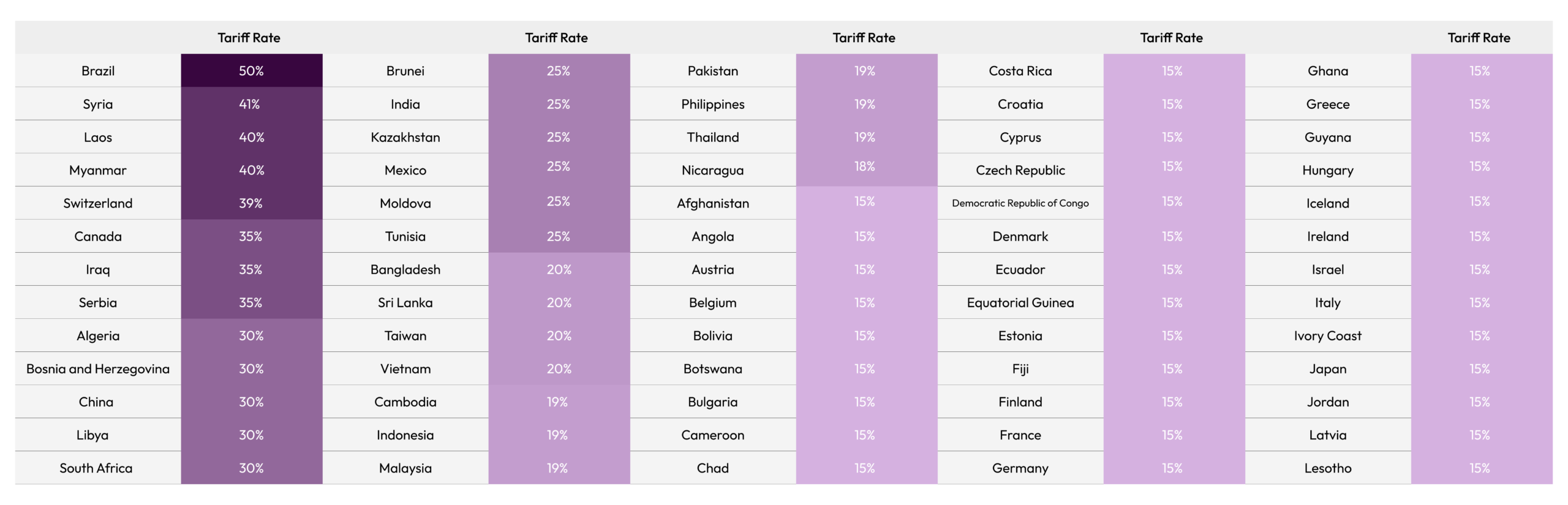

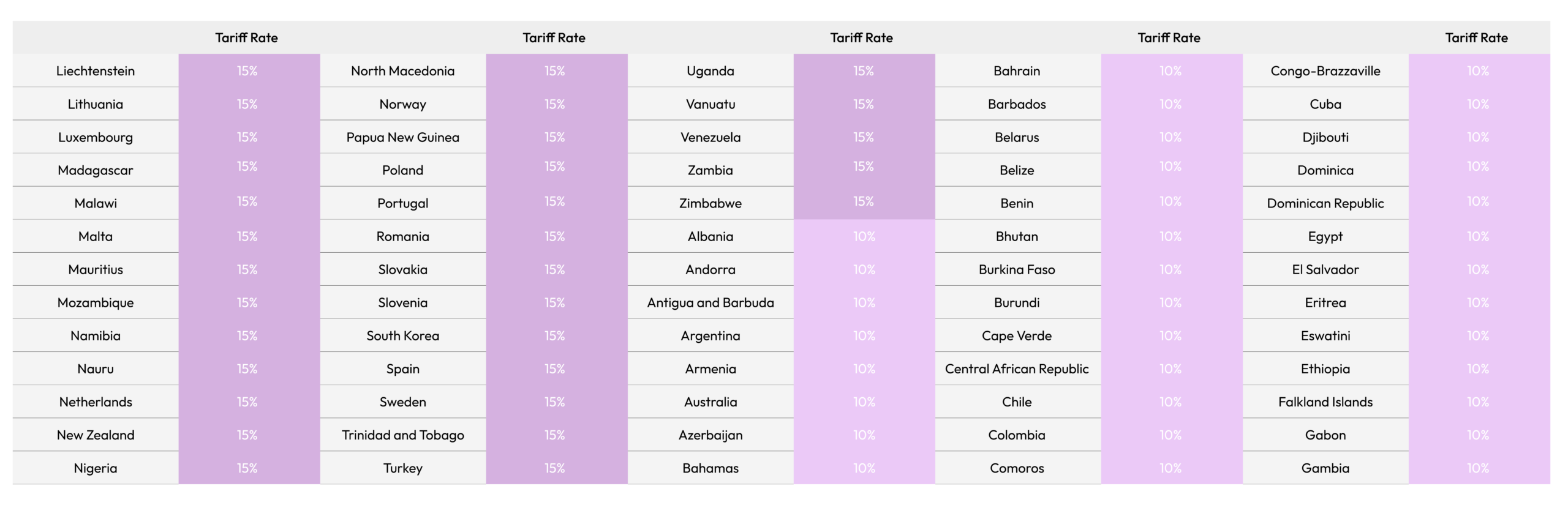

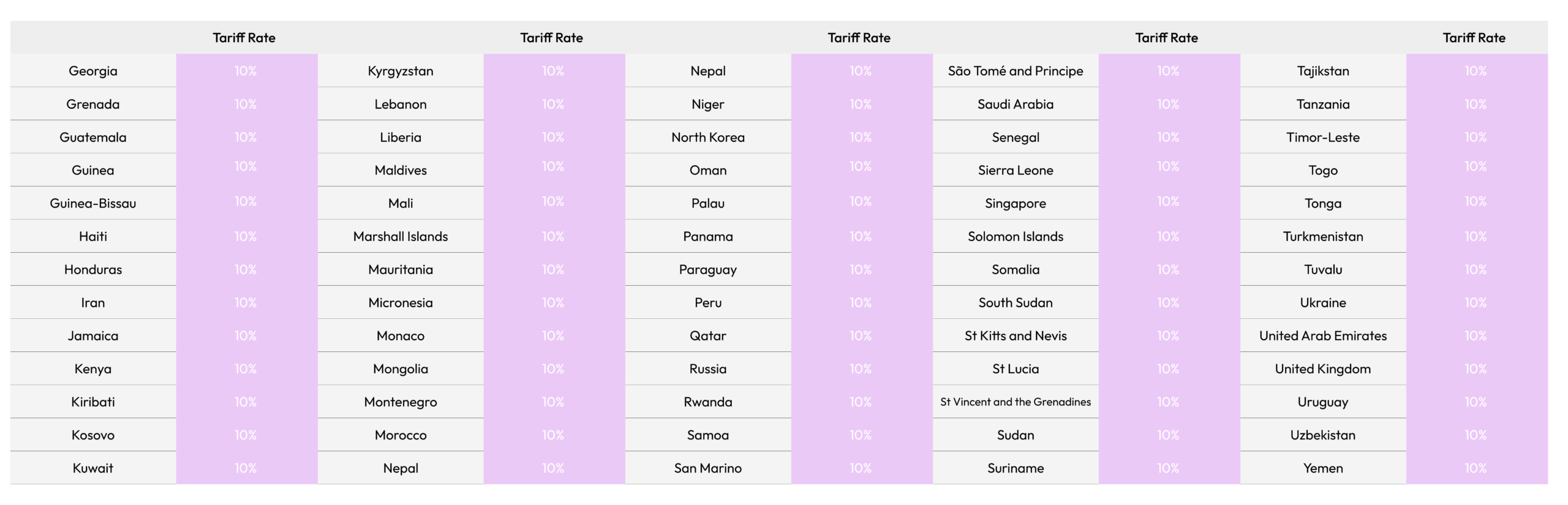

Tariffs by Countries

The updated tariff rates take effect on August 7 at 12:01 a.m. EST for most countries, with exceptions for Canada, Mexico, China, and North Korea, each of which follows a different implementation timeline.

FAQ: U.S. Reciprocal Tariffs in 2025

Q1: Why are some countries facing tariffs as high as 35–50%?

High tariffs are typically applied to countries that export goods in industries the U.S. views as strategically sensitive or politically leveraged. Commonly affected sectors include:

- Agriculture (e.g., Brazil, Argentina)

- Pharmaceuticals and medical ingredients (e.g., India, China)

- Luxury goods (e.g., France, Italy)

- Critical minerals like copper (e.g., Chile, Peru)

The U.S. often uses these tariffs to protect domestic industries or pressure trade partners into broader negotiations.

Q2: Are any countries getting more favorable treatment?

Yes. Countries considered Tier‑1 trade allies—such as Japan, the EU, and South Korea—have secured reciprocal trade agreements that lock in reduced tariff rates (typically 10–15%).

These agreements often include broader cooperation in areas like semiconductors, clean energy, and digital trade, making their export conditions more stable and predictable.

Q3: Is this shift in tariffs permanent?

No. U.S. tariff policy has evolved into a strategic foreign policy tool, meaning it’s subject to change based on:

- U.S. elections and political leadership

- Geopolitical events

- Industry lobbying and sector-specific negotiations

While some trade deals offer temporary stability, businesses should stay agile and continuously monitor policy developments.

Q4: Are digital products or services affected?

In many bilateral trade deals—such as those with Japan, the EU, and Singapore—digital products like software, e-books, and streaming services are zero-rated.

However, cross-border data restrictions and data residency rules may still apply, depending on the service type and jurisdiction. Compliance with digital regulations is just as critical as tariff planning.

Q5: How can my business prepare for sudden tariff changes?

Stay ahead by:

- Monitoring updates from official sources like the USTR, CBP, and international trade bulletins

- Using digital classification and compliance tools to track product-specific rules

- Diversifying suppliers and building flexibility into your sourcing and warehousing strategies

In today’s landscape, resilience and visibility are your best defenses against surprise cost increases.

In exchange, Japan agreed to expand purchases of U.S. agriculture and reaffirm its support for bilateral semiconductor and battery cooperation. The two sides committed to strengthening R&D partnerships and co-investing in resilient semiconductor supply chains—targeting advanced chip packaging and critical inputs like photoresist materials.

The agreement also included a $550 billion investment and loan package, directed toward joint ventures in energy infrastructure, pharmaceuticals, and rare earth processing. This strategic cooperation is designed to reduce dependence on China while deepening U.S.–Japan economic ties.

Turn Tariff Complexity Into Supply Chain Advantage

Global tariffs are changing fast—but your logistics strategy doesn’t have to fall behind. ZhenHub gives you the tools to adapt in real time, with access to a global fulfillment network, automated customs support, and insights to keep your landed costs under control. Join ZhenHub today to ship smarter across borders, or connect with our team to learn how we help businesses thrive in a shifting trade environment.