Internet Sales Tax Rates by State 2022 Update

Time to read: 9 minutes

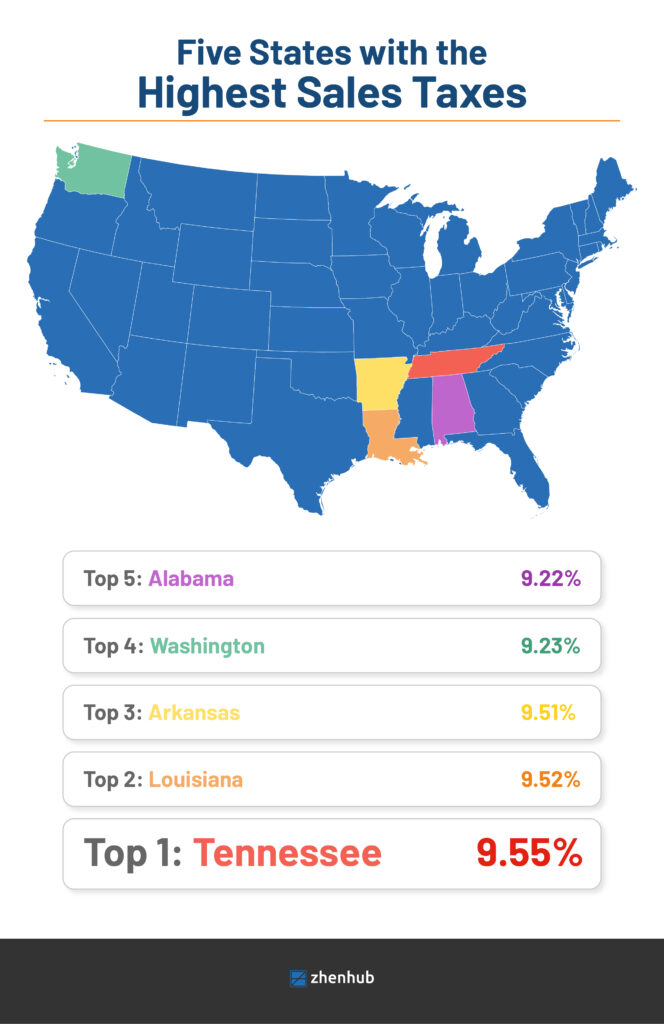

Consumer behaviors changed over the last two years. With more people at home, the pandemic bolstered retail sales exponentially. It resulted in an unprecedented double-digit increase in sales tax revenue across multiple states.

Twenty-seven US states reported an average of 20% increase in their sales tax revenue in 2020. Experts speculate that the upward trend is due, in part, to several factors. The pandemic lessened consumer spending on services. Spending has been redirected to purchasing retailer products. The stimulus packages also increased the purchasing power of Americans. Moreover, since 2018, most states have collected taxes for online sales.

Legislation has to catch up to accommodate these recent and rapid shifts in consumer behavior. This article covers an overview of the current internet sales tax rates in 2022, as well as a rundown of the economic nexus legislation.

Changes in Internet Sales Tax Rates by State 2022

Internet Sales Tax Rates were a product of the 2018 Supreme Court Wayfair ruling. It required out-of-state sellers to collect sales taxes from their in-state consumers. Three years since the mandate and with the COVID-19 pandemic happening, the 2018 ruling is getting amended to accommodate the fairness for small online businesses.

The changes focus on abolishing the economic nexus imposed on all online sellers. This development means that small retailers are no longer required to pay sales taxes based on the number of units they sell. Instead, sales tax is required when sales exceed the amount threshold.

Economic Nexus Legislation

As mentioned earlier, in June 2018, the Supreme Court ruled in favor of the state in South Dakota v. Wayfair, Inc. The new law allowed South Dakota to impose sales taxes on remote purchases. Before South Dakota v. Wayfair, the state could only enforce tax collection on businesses with a physical location in the state. This law includes brick-and-mortar establishments as well as remote workers.

In the three years since the ruling, forty other states have imposed their version of the same legislation in their jurisdiction:

Economic Nexus by State

| State | Taxation Threshold | Measurement Date | Includable Sales (Gross, Retail, or Taxable) | When You Need to Register Once You Exceed the Threshold |

| Alabama | $250,000 + specified activities | Previous calendar year | Retail sales. Marketplace sales excluded from the threshold for individual sellers | January 1 following the year the threshold is exceeded |

| Alaska | Per Remote Seller Sales Tax Code & Common Definitions: $100,000 or 200 transactions | Per Remote Seller Sales Tax Code & Common Definitions: Previous calendar year | Per Remote Seller Sales Tax Code & Common Definitions: Gross sales. Marketplace sales excluded towards the threshold for individual sellers. | The first day of the month following 30 days from adoption by the city or borough |

| Arizona | $200,000 in 2019; $150,000 in 2020; and $100,000 in 2021 and thereafter | Previous or current calendar year | Gross sales. Marketplace sales excluded from the threshold for individual sellers | The seller must obtain a TPT license once the threshold is met and begin remitting the tax on the first day of the month that starts at least thirty days after the threshold is met for the remainder of the current year and the following calendar year. |

| Arkansas | $100,000 or 200 or more separate transactions | Previous or current calendar year | Taxable sales. Marketplace sales excluded from the threshold for individual sellers | Next transaction |

| California | $500,000**California enacted legislation that raised the sales threshold and removed the number of transactions threshold on April 25, 2019. | Preceding or current calendar year | Gross sales of tangible personal property. Marketplace sales included towards the threshold for individual sellers | The day you exceed the threshold |

| Colorado | $100,000**Colorado removed its 200 transactions threshold by permanent rules, effective April 14, 2019. | Previous or current calendar year | Retail sales. Marketplace sales excluded from the threshold for individual sellers | The first day of the month after the ninetieth day, the retailer made retail sales in the current calendar year that exceeded $100,000 |

| Connecticut | $250,000 and 200 transactions$100,000 and 200 transactions – applicable to sales on or after July 1, 2019**Connecticut lowered its dollar threshold from $250,000 to $100,000, keeping the number of transactions the same, effective July 1, 2019. | 12-month period ending on September 30 | Retail sales. Marketplace sales included towards the threshold for individual sellers | October 1 of the year in which you cross the threshold on September 30 |

| Delaware | N/A | N/A | N/A | N/A |

| District of Columbia | $100,000 or 200 or more separate retail sales | Previous or current calendar year | Retail sales. Marketplace sales included towards the threshold for individual sellers | Next transaction (not specified by District) |

| Florida | $100,000 | Previous calendar year | Taxable sales. Marketplace sales excluded from the threshold for individual sellers | Next transaction (the state doesn’t specify) |

| Georgia | $250,000 or 200 or more sales (effective January 1, 2019, through January 1, 2020)$100,000 or 200 or more sales**Georgia enacted legislation in April 2019 that lowered the sales threshold to $100,000 but kept the 200 transactions threshold unchanged, effective January 1, 2020. | Previous or current calendar year | Whether taxable or exempt, retail sales of tangible personal property are delivered electronically or physically. Marketplace sales excluded from the threshold for individual sellers | Next transaction |

| Hawaii | $100,000 or more or 200 or more separate transactions | Current or immediately preceding calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | The first of the month follows when the threshold is met. |

| Idaho | $100,000 | Previous or current calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | Next transaction (the state doesn’t specify) |

| Illinois | $100,000 or more or 200 or more separate transactions | Preceding 12-month period | Retail sales. Marketplace sales excluded from the threshold for individual sellers | The retailer shall determine every quarter whether they meet the criteria for the preceding 12-month period |

| Indiana | $100,000 or 200 or more separate transactions | The calendar year in which the retail transaction is made or for the calendar year preceding the calendar year in which the retail transaction is made. | Gross sales. Marketplace sales excluded from the threshold for individual sellers | Immediately upon reaching the threshold |

| Iowa | $100,000 – effective July 1, 2019*$100,000 or 200 or more separate transactions before July 1, 2019*Iowa removed its 200 transactions threshold on May 3, 2019. Effective July 1, 2019, only the $100,000 threshold applies to remote sellers, marketplace facilitators, and referrers. | Current or immediately preceding calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | The first day of the following calendar month that starts at least 30 days from the day the remote seller first exceeded the threshold |

| Kansas | $100,000 | Current or immediately preceding calendar year**Only for the calendar year 2021 sales since January 1, 2021 | Gross sales*Marketplace sales included towards the threshold for individual sellers*For marketplace facilitators, it is taxable instead of gross per Notice 21-14. | Next transaction |

| Kentucky | $100,000 or 200 or more separate transactions | Previous or current calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | First of the calendar month that is at the most 60 days after either threshold is met |

| Louisiana | $100,000 or 200 or more separate transactions | Previous or current calendar year | Gross sales. Marketplace sales excluded from the threshold for individual sellers | Within 30 days of exceeding the threshold, the remote seller must submit an application to the Louisiana Remote Seller Commission and must begin collecting state and local sales and use tax based upon actual applicable bases and rates on sales for delivery into Louisiana within 60 days. |

| Maine | $100,000**Maine enacted legislation on June 11, 2021, to remove the 200 transaction count threshold from the state’s economic nexus rules for remote sellers effective January 1, 2022. | Previous or current calendar year | Gross sales. Marketplace sales are excluded from the threshold for individual sellers and don’t include marketplace sales on return if reported by the marketplace | Next transaction |

| Maryland | $100,000 or 200 or more separate transactions | Previous or current calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | First day of the month following when the threshold is met |

| Massachusetts | $500,000 and 100 or more transactions$100,000**Massachusetts enacted legislation on August 1, 2019, to change its thresholds. Effective October 1, 2019, the threshold will be $100,000 and no transaction threshold. | Preceding calendar year | Gross sales. Marketplace sales are excluded from the threshold for individual sellers if the marketplace facilitator collects. | If it exceeds the threshold by October 31, register as of January 1 the following year. If the threshold exceeds between November 1 and December 31, register on the first of the month following two months after you exceed the threshold.. |

| Michigan | $100,000 or 200 or more separate transactions | Previous calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | January 1 following the year the threshold is exceeded |

| Minnesota | $100,000 and 10 sales or 100 transactions$100,000 or 200 or more retail sales**Minnesota has changed its thresholds. Effective October 1, 2019, the thresholds will be $100,000 or 200 transactions. | The twelve-month period ending on the last day of the most recently completed calendar quarter | Retail sales. Marketplace sales included towards the threshold for individual sellers | On the first taxable retail sale into Minnesota that occurs no later than 60 days after you exceed the Small Seller Exception |

| Mississippi | More than $250,000 | Prior twelve-month period | Gross sales. Marketplace sales excluded from the threshold for individual sellers | Next transaction |

| Missouri | $100,000 | Previous twelve-month period | Taxable sales | Not more than three months following the close of the preceding calendar quarter |

| Montana | N/A | N/A | N/A | N/A |

| Nebraska | $100,000 or 200 or more separate transactions | Previous or current calendar year | Retail sales. Marketplace sales included towards the threshold for individual sellers | The first day of the second calendar month after the threshold was exceeded |

| Nevada | $100,000 or 200 or more separate transactions | Previous or current calendar year | Retail sales. Marketplace sales included towards the threshold for individual sellers | By the first day of the calendar month that begins at least 30 calendar days after they hit the threshold |

| New Hampshire | N/A | N/A | N/A | N/A |

| New Jersey | $100,000 or 200 or more separate transactions | Previous or current calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | Next transaction |

| New Mexico | $100,000 | Previous calendar year | Taxable sales. Marketplace sales excluded from the threshold for individual sellers | January 1 following the year the threshold is exceeded |

| New York | $500,000 in sales of tangible personal property and more than 100 sales**New York raised its economic nexus threshold from $300,000 to $500,000 on June 24, 2019. The number of transaction thresholds remains the same at 100 sales. | Immediately preceding four sales tax quarters | Gross receipts from sales of tangible personal property. Marketplace sales included towards the threshold for individual sellers | Register within 30 days after meeting the threshold and begin to collect tax 20 days thereafter |

| North Carolina | $100,000 or 200 or more separate transactions**North Carolina removed its economic nexus threshold for marketplace facilitators, effective July 1, 2020. | Previous or current calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | Next transaction**Update based on the 2021 SST Disclosed Practice 8 submitted by the state; this has changed from 60 days to the next transaction |

| North Dakota | $100,000**North Dakota removed its 200 transactions threshold effective for tax years beginning after December 31, 2018. | Previous or current calendar year | Taxable sales. Marketplace sales excluded from the threshold for individual sellers | The following calendar year or 60 days after the threshold is met, whichever is earlier |

| Ohio | $500,000$100,000 or 200 or more separate transactions**Ohio lowered its threshold from $500,000 to $100,000 or 200 transactions effective August 1, 2019. | Previous or current calendar year | Retail* sales. Marketplace sales included towards the threshold for individual sellers*Clarification and update based on the 2021 SST Disclosed Practice 8 submitted by the state | Remote sellers and marketplace sellers: Next transactionMarketplace facilitators: 1st of the month following at least 30 days after meeting threshold; remote sellers and marketplace sellers: the next day after meeting or exceeding the threshold |

| Oklahoma | $100,000 in aggregate sales of TPP | Preceding or current calendar year | Taxable sales. Marketplace sales excluded from the threshold for individual sellers | The first calendar month following the month when the threshold is met |

| Oregon | N/A | N/A | N/A | N/A |

| Pennsylvania | $10,000 or comply with the notice and reporting requirements$100,000 | Previous 12-month period. Prior calendar year and then starting in the 2nd quarter – collection period 7/1/19 through 3/31/20 using CY 2018; and then collection period 4/1/20-3/31/21 using the calendar year 2019 | Taxable sales. Gross sales on all channels, including taxable, exempt, and marketplace sales | On or before June 1 of each calendar yearApril 1 following the calendar year when the threshold was exceeded |

| Rhode Island | $100,000 or 200 or more separate transactions | Immediately preceding calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | January 1 following the year the threshold is exceeded |

| South Carolina | $100,000 | Previous or current calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | The first day of the second calendar month after economic nexus is established |

| South Dakota | $100,000 or 200 or more separate transactions | Previous or current calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | Next transaction |

| Tennessee | $500,000*$100,000 starting October 1, 2020***Tennessee enacted legislation on May 21, 2019, that authorizes the DOR to enforce its economic nexus rule, effective July 1, 2019. However, the state will not require out-of-state sellers to collect tax until October 1, 2019.**Tennessee passed legislation that lowers the economic nexus threshold from $500,000 to $100,000, effective October 1, 2020. | Previous 12-month period | Retail sales. Marketplace sales excluded from the threshold for individual sellers effective October 1, 2020 | The first day of the third month following the month in which the dealer met the threshold, but no earlier than July 1, 2017 |

| Texas | $500,000 | Preceding twelve calendar months | Gross revenue: including taxable, nontaxable, and tax-exempt sales. Marketplace sales included towards the threshold for individual sellers | The first day of the fourth month after the month in which the seller exceeded the safe harbor threshold |

| Utah | $100,000 or 200 or more separate transactions | Previous or current calendar year | Gross sales. Marketplace sales excluded from the threshold for individual sellers | Next transaction |

| Vermont | $100,000 or 200 or more separate transactions | Prior four calendar quarters | Gross sales. Marketplace sales included towards the threshold for individual sellers | First of the month, after 30 days from the end of the quarter that you exceed the threshold |

| Virginia | $100,000 or 200 or more separate transactions | Previous or current calendar year | Retail sales. Marketplace sales excluded from the threshold for individual sellers | Next transaction (the state doesn’t specify) |

| Washington | $10,000 or comply with the notice and reporting requirementsGross income of the business exceeding $100,000**October 1, 2018, through December 31, 2019, sellers with 200 or more separate transactions into Washington must collect. However, effective March 14, 2019, the threshold will only be $100,000. The state removed the 200 transactions threshold. | Current or preceding calendar yearCurrent or preceding calendar year | Retail sales. Gross sales*Marketplace sales included towards the threshold for individual sellers*October 1, 2018 through December 31, 2019, Washington used a retail sales standard. Effective January 1, 2020, it became a gross income standard. | The first day of the month that starts at least 30 days after you meet the thresholdThe first day of the month that starts at least 30 days after you meet the threshold |

| West Virginia | $100,000 or 200 or more separate transactions | Preceding or current calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers | Next transaction |

| Wisconsin | $100,000**Wisconsin removed its 200 transactions threshold effective February 20, 2021. | Previous or current calendar year | Gross sales. Marketplace sales included towards the threshold for individual sellers – but if all sales are made through a marketplace that is collecting, the individual seller is not required to register | Next transaction |

| Wyoming | $100,000 or 200 or more separate transactions | Previous or current calendar year | Gross sales. Marketplace sales excluded from the threshold for individual sellers | Next transaction |

*Date from the Sales Tax Institute

Final Word

The economic nexus legislation varies from state to state. As a result, navigating through this complex and ever-changing law can be challenging even for seasoned online retailers. Moreover, it is a full-time job for most operations.

If you are new to eCommerce, you need a partner that can take the burden of logistics off of your shoulders. With ZhenHub, you can dedicate your time to learning more about the economic nexus legislation without worrying about your supply chain operations. Our tech-based logistics solutions are designed to support you at every step of the way. From warehousing to inventory management, we have got you covered. Contact us today for a free quote.