The Ultimate VAT Guide for Ecommerce Retailers in Europe

Time to read: 7 minutes

Reading time: 3 min 45s

The Ultimate VAT Guide for Ecommerce Retailers in Europe

The EU is a massive market for retail sales.

But ecommerce retailers have to understand the basics of EU VAT rules along with applicable VAT on online sales when selling into Europe. This is important to avoid unwanted risks and complications. These risks could come in the form of delivery delays that could affect customer experience as well as costly penalties that can affect your bottom line.

Ecommerce sales in Europe peaked at 621 billion in 2019, according to ecommerce News. If you’re eyeing a piece of this cake, this guide has been compiled to help you get started.

What is VAT?

According to Investopedia;

Value Added Tax is a consumption tax levied on products at every stage of the supply chain, where value is added.

It is known as good and services tax (GST) in some countries and unlike the sales tax in the US that is only charged on the final consumer, VAT is paid by everyone involved from production to the point of sale. These include raw materials suppliers, product manufacturers, distributors, retailers, and the final consumer.

Key EU VAT rules

The VAT is applicable to almost all EU member states.

Everyone from taxable individuals to businesses and corporate entities is liable to VAT. However, governments and public offices, and a few EU territories like Gibraltar, Channel Islands, and the Canary Islands are exempted from VAT.

VAT is applicable to most sales and purchases made in the EU by companies based in the EU. However, insurance, postal services, and medical care services are often exempted from VAT.

Exports to non-EU countries are also exempted from VAT if you can provide evidence of such exports. There are usually broad EU VAT Directives although member states still enjoy some sort of flexibility to apply them differently.

VAT rates in Europe

Countries in Europe have different VAT rates.

The VAT rate applied in any EU country will depend on the type of goods. You can check VAT rates online at Avalara. Better still, you can confirm at your local VAT office.

That said, here are the different types of VAT rates in Europe;

- Standard rates: Different rates for each country. Luxembourg has the lowest VAT rate at 17% and Hungary has the highest at 27%. It cannot be lower than 15% according to EU VAT rules.

- Reduced rates: Reduced rates are applicable to a variety of sales but cannot go lower than 5%.

- Super-reduced rates: This can be lower than 4% and applicable in some countries to certain products and services.

- Zero rates: Applicable in some countries for certain sales. Consumers get to avoid paying VAT on products and services with zero rates. If you’ve paid VAT on purchases directly related to the sale, you’re allowed to deduct this.

- Special & parking rates: Some EU countries are allowed to set special rates on certain sales that are usually not eligible for a reduced rate. These special rates are known as parking or intermediary rates.

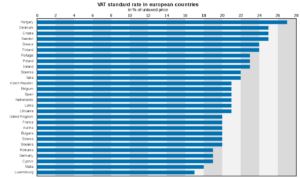

Standard VAT rates in EU-28 Member States

Credit: Statista

What’s the difference between zero-rated and VAT exempt?

It’s easy to mistake both of these for each other.

The key difference is that being zero-rated does not mean a particular item is VAT-exempt. Such items are still taxable and must be recorded alongside other sales when you file your VAT returns. Additionally, they’ll count towards your threshold. VAT-exempt items, however, don’t have to be recorded with sales when you submit your VAT returns.

EU distance selling regulations and VAT on Ecommerce sales

EU distance selling regulations are the set of rules that guide distance sales.

Distance sales, on the other hand, are those sales of products and services to businesses and individuals in another EU member state, especially where there is no physical contact. Ecommerce sales over the internet across EU borders fall under distance sales and are guided by the EU distance selling regulations.

EU VAT rules on distance selling

Sales of goods and services to individuals in a different EU state are liable to VAT charges. The buyer is expected to pay the seller the VAT due and so the VAT is usually not paid in the buyer’s country.

However, there are different EU VAT thresholds in different countries. Once a seller’s annual sales exceed a particular country’s VAT threshold, they are expected to charge VAT in the seller’s country.

Annual EU distance selling threshold

| Austria | € 35,000 |

| Belgium | € 35,000 |

| Bulgaria | BGN 70,000 |

| Croatia | HRK 270,000 |

| Cyprus | € 35,000 |

| Czech Republic | CZK 1,140,000 |

| Denmark | DKK 280,000 |

| Estonia | € 35,000 |

| Finland | € 35,000 |

| France | € 35,000 |

| Germany | € 100,000 |

| Greece | € 35,000 |

| Hungary | HUF 8,800,000 |

| Ireland | € 35,000 |

| Italy | € 35,000 |

| Latvia | € 35,000 |

| Lithuania | € 35,000 |

| Luxembourg | € 100,000 |

| Malta | € 35,000 |

| Netherlands | € 100,000 |

| Norway | N/A |

| Poland | PLN 160,000 |

| Portugal | € 35,000 |

| Romania | RON 118,000 |

| Slovakia | € 35,000 |

| Slovenia | € 35,000 |

| Spain | € 35,000 |

| Sweden | SEK 320,000 |

| Switzerland | N/A |

| United Kingdom | £70,000 |

Credit: Avalara

VAT on non-EU imports

If you’re importing from China and other non-EU states, you’ll still have to pay VAT on the goods or services imported at the rate applicable in the country where the goods are to be sold.

VAT on imports from non-EU countries are treated the same way as input tax.

This VAT is charged at the border, alongside customs duty, and other applicable fees. There’s an exception, however, in some cases, for low-value shipments. This is known as the Low Value Consignment Relief.

VAT registration in Europe

If your business involves selling across EU borders, you may need to register for a local VAT number in another country. Different countries have different requirements for VAT registration. Although this usually depends on the EU’s VAT directive, you’ll need to register for a VAT if your business meets one or more of the following conditions;

- You sell goods on the internet (distance sales)

- You buy/sell goods in another country

- You import goods into an EU-member state

- You offer warehousing services

- You hold live conferences, training, or exhibitions where people pay fees

- Your business involves certain equipment supply and installation services

These registration requirements apply to every business within or outside the EU.

While resident companies may want to check out their VAT threshold, non-resident companies are obligated to register for VAT as soon as possible.

New EU VAT system for online businesses

The finance ministers of the EU agreed in December 2017 to bring certain changes to the EU VAT system to bring much ease and greater VAT compliance to online ecommerce businesses.

The European Commission reports that these VAT digitization changes will take effect by January 2021. This will give birth to a common Value Added Tax (VAT) system where businesses can easily register for a single VAT number and file a single tax return for the entire EU instead of having to register in each EU country where they operate.

For countries in the EU, this means more tax revenue.

But ecommerce businesses will also benefit from the reduced bureaucracy and the other costs currently associated with EU VAT registration.

How to get an EU VAT Number

Companies buying and selling in the EU need to get a VAT Number.

The process starts with first getting VAT registration for EU companies and tax registration for non-EU companies. These companies can then get a local VAT form to be completed and submitted along with a few other documents.

According to Avalara, these other documents may include;

- Proof of VAT or tax registration in the country of domicile

- An original copy of the certificate of incorporation

- A copy of your Articles of Association

- Proof of existence (could be an extract from the national company registrar)

- Contracts or invoices as proof of the planned trade

- Power of Attorney or Letter of Authority, in cases where a fiscal representative or a local tax agent is appointed by the company.

Oftentimes, the tax authorities may ask you some other questions in a bid to prevent tax fraud. Once the application process is done, you should be able to get your VAT number after some weeks. This varies from country to country and can range from as fast as 2 weeks to as long as 8 weeks.

Every EU country has its own EU VAT Number format. However, once you’ve received your VAT, you can start trading and can now charge VAT on your transactions.

Moss VAT returns

Every EU country has its own specific language, frequency, as well as, a specific deadline for VAT returns. The Mini-One-Stop-Shop (MOSS), however, is a centralized VAT reporting internet portal for quarterly VAT filings for e-services businesses across the EU.

VAT registered businesses will get access to the MOSS portal upon registration.

The receiving tax authority will divide the VAT received which will then be transferred to the country of the consumers. With MOSS, ecommerce retailers won’t have to register for VAT in every single EU country where they sell. Filings are expected to be done on this portal every 20th day of the month following the quarter in question.

Other reporting obligations

Businesses shipping to the EU may have to obtain an EORI Number.

The EORI Number stands for European Operator Identifier Number. It is linked to the VAT Number and is meant to help European customs authorities identify your shipments. This is important to issue documentation when you need to reclaim import VAT paid at customs.

Some other reporting obligations may include;

Intrastat declarations; which are mandatory statistical reports which are used by EU tax authorities to monitor the movement of goods across EU member states’ borders.

EC Sales Lists; which is an additional reporting obligation required to document intra-community stock movement when stock is sold or transferred between countries in the EU.

Will Brexit affect VAT and sales into Europe?

Possibly!

As it is, a lot of non-EU sellers use the UK as their gateway to sell into the EU single market. With the UK already out of the EU, there’s bound to be certain changes, although everything still stands as it used to be at the moment.

Trade talks are ongoing between both parties.

Once the UK finally exits the EU, sellers will have to do new VAT registration elsewhere (Spain, Ireland, Germany, etc) as the UK will no longer have access to the EU single market. Once you’ve done your registration in a new place, you’ll be able to once again gain access to the EU market and deliver goods to your EU customers.

Currently, the EU distance selling regulations are still in place in the UK and changes are not expected until at least the next two years, or even longer.

Planning ahead

The key is to not be discouraged by the EU VAT rules but rather to get a better grasp of the rules and plan ahead. The EU market presents a massive opportunity for ecommerce businesses. Staying compliant with custom duty and tax rules, among other things will prove very vital for your business growth.

This is why proactive planning should be the foundation of all of your business strategies.

At ZhenHub, we’re committed to helping you maximize efficiency so your ecommerce business can grow at a steady pace. We offer ecommerce software, inventory management, shipping, as well as warehousing and order fulfillment services. If you’re looking to give your business a competitive advantage, you can contact us today to get started!

If you need assistance with reducing logistics costs, you can reach out to our specialists – hello(a)zhenhub.com or submit an enquiry here.