How to Choose a Fulfillment Center Location in 2026

Time to read: 5 minutes

A great product stuck in the wrong warehouse is a liability, not an asset. In today’s market, the physical distance between your inventory and your customer is the single biggest variable in your profit equation.

We often think of logistics as “moving boxes,” but in 2026, it is really about managing expectations. The data is unforgiving: with 61% of shoppers buying weekly and 93% experiencing delays, delivery failures are a major friction point. When nearly half of customers are forced to chase down their own orders, one delay doesn’t just cost you a refund; it costs you their loyalty.

Choosing a location isn’t just about finding cheap rent. It is a strategic balancing act between speed, cost, and risk. You are not just renting space; you are positioning your brand to survive the next global rush—whether that is Christmas, Cyber Week, or Singles’ Day (11.11).

And in 2026, with customer expectations rising even further, choosing the right hub matters more than ever.

TL;DR: The 5-Step Location Strategy

Here is the quick roadmap to choosing the right logistics hub.

| Step | Focus Area | The Risk | The Fix |

| 1. Map Your Demand | Customer Density | Shipping across too many “zones” kills margins. | Place hubs where 80% of customers are within a 2-day ground zones. |

| 2. Secure the Entry | Inbound Gateways | High “drayage” (trucking) fees from ports. | Choose warehouses near major gateways like Shanghai or Long Beach. |

| 3. Audit the Workforce | Labor Stability | Orders stuck in backlog during peak season. | Prioritize regions with deep labor pools or high automation. |

| 4. Check the Fine Print | Taxes & Incentives | Hidden “inventory taxes” eating profits. | Utilize Free Trade Zones (FTZs) to defer duties and improve cash flow. |

| 5. Get Closer | Micro-Fulfillment | Losing urban customers to same-day competitors. | Use small urban hubs for instant delivery in cities like Tokyo or NYC. |

1. Map Your “Customer Heatmap” to Cut Zones

Your first move requires looking outward at your data. Since the “last mile” delivery to the customer accounts for nearly half of total shipping costs, your inventory needs to sit as close to the majority of your buyers as possible to reduce carrier shipping zones.

If you are selling in the UK, a single centrally located warehouse in the Midlands can often reach 90% of the population within four hours. However, in vast territories like the US or China, a single hub rarely suffices. While a warehouse in Kansas might seem central for the US market, utilizing two hubs—one near population centers on the East Coast and another on the West Coast—often results in significantly cheaper overall rates and faster delivery times due to “zone skipping.” Similarly, for Europe, placing hubs in both Western Europe (e.g., the Netherlands) and Central Europe (e.g., Poland or Germany) increasingly proves cost-effective for scaling brands.

Before looking at real estate, export your last six months of order data and map the delivery postcodes. Where you see clusters on that heatmap—whether it’s the Gold Coast of Australia or the Guangdong province in China—is where your search should begin.

2. Trace the Path from the Port (Inbound Strategy)

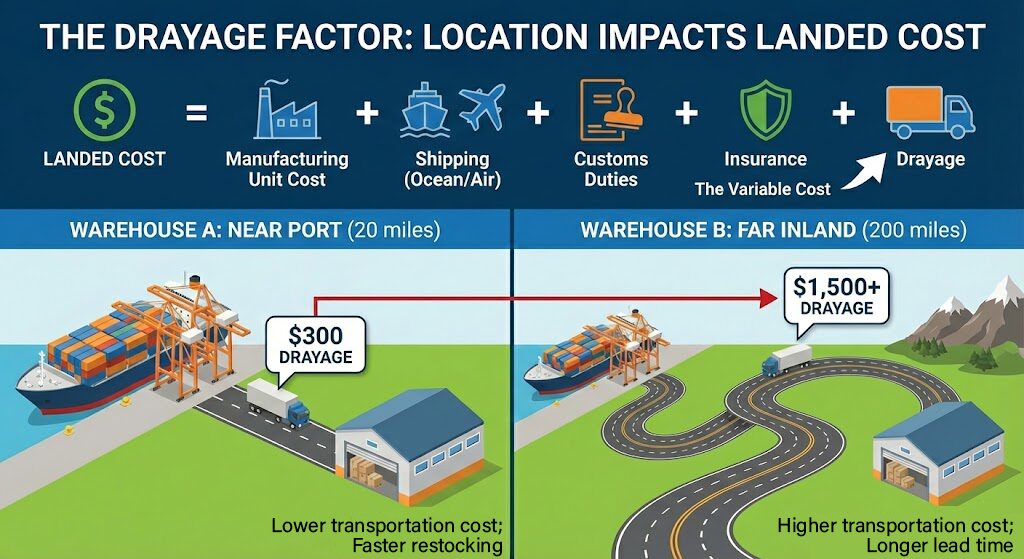

Once you know where your customers are, you need to determine how efficiently you can get goods to the warehouse. Recent supply chain disruptions have taught us that relying on a facility 500 miles from the nearest port adds significant lead time and expensive “drayage” (trucking fees) to every shipment. This remains especially relevant in 2026 as drayage rates continue trending upward across major global ports.

When evaluating a partner, you must look beyond the storage fee and calculate the “Landed Cost” of getting a container to their door. This is the true cost of your inventory before you even sell a single unit.

Landed Cost = Manufacturing Unit Cost + Shipping (Ocean/Air) + Customs Duties + Insurance + Drayage

The “Drayage” is the variable that changes based on location. It is the cost to truck the container from the port to the warehouse. A warehouse 20 miles from the Port of Los Angeles might charge $300 for drayage, while a “cheaper” warehouse 200 miles inland could cost $1,500+ per container. Over a year of restocking, that extra distance can burn through thousands of dollars in profit, negating any savings you made on rent. The same pattern is seen near Rotterdam, Hamburg, and Singapore ports—proximity almost always beats cheaper inland rent.

3. Vet the Local Labor Market

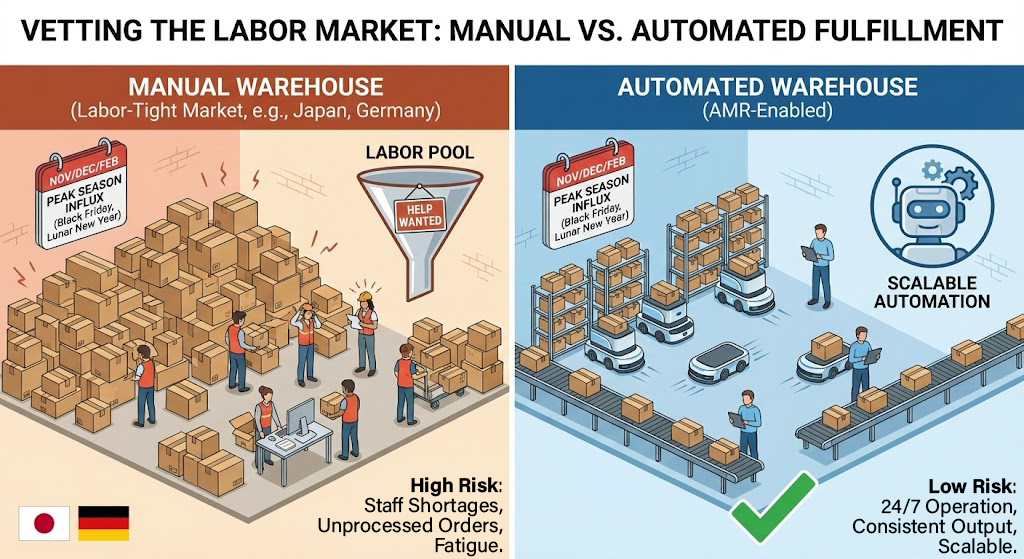

You might find a warehouse with incredibly low rent in a remote area, but cheap rent often signals a shallow labor pool. This step is about ensuring the facility can actually operate when it matters most.

The global logistics industry is facing a significant talent gap, particularly in aging societies. For instance, Japan’s working-age population has declined by ~16% from its peak, creating severe staffing pressure. If a fulfillment center cannot hire enough staff during a massive influx like Black Friday or Lunar New Year, your orders will sit unprocessed regardless of how good the location is.

In labor-tight markets like Japan or Germany, highly automated warehouses utilizing autonomous mobile robots (AMRs) are often a safer bet than manual ones. They don’t get tired, and they aren’t subject to labor shortages. Always ask a potential partner: How do you scale your workforce during peak season? This question becomes even more important in 2026 as labor shortages persist across both developed and emerging markets.

4. Audit Local Taxes and Business Incentives

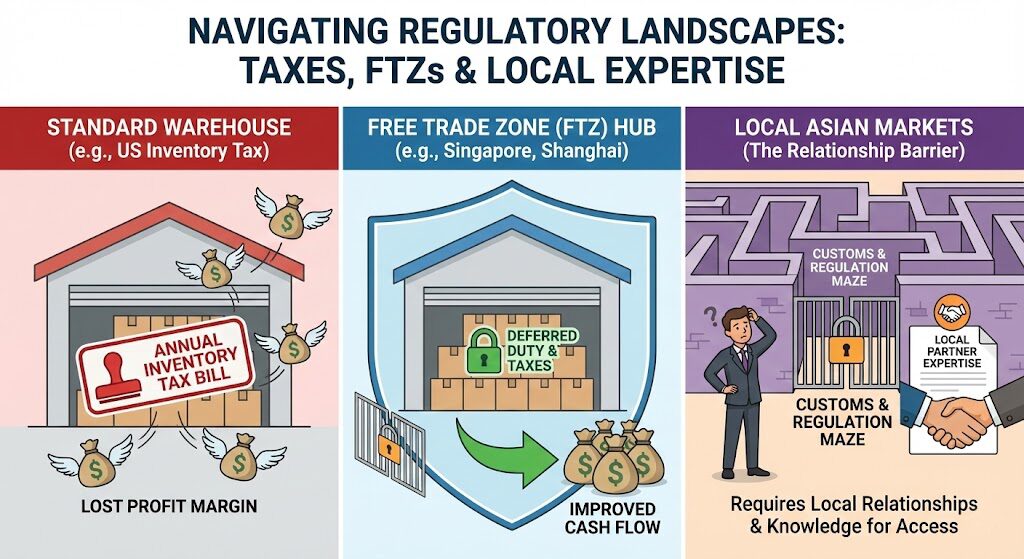

Before signing an agreement, it is wise to investigate the local regulatory environment. Regulations vary wildly by region, and understanding them can uncover hidden savings.

Some regions impose specific taxes just for holding inventory. For example, certain US states tax goods held in stock annually, whereas neighboring states might not, making a location just across a state line significantly more profitable. Conversely, many Asian hubs offer Free Trade Zones (FTZs), such as in Singapore or Shanghai. Storing goods in an FTZ allows you to defer duty payments until the product is shipped to the final customer, effectively freeing up significant working capital. In Europe, similar benefits exist in bonded warehouses across countries like the Netherlands and Belgium, providing more flexibility for cross-border sellers.

It’s also worth noting that in many Asian markets, successfully navigating local regulations and customs often requires established local relationships and specialized knowledge, which can be a barrier for outsiders acting alone.

5. Layer in “Micro-Fulfillment” for Speed

The final piece of the puzzle is optimizing for your most valuable, time-sensitive customers in dense urban areas. If you have a high concentration of buyers in a major metropolis, a massive warehouse located two hours outside the city limits may no longer be fast enough to compete.

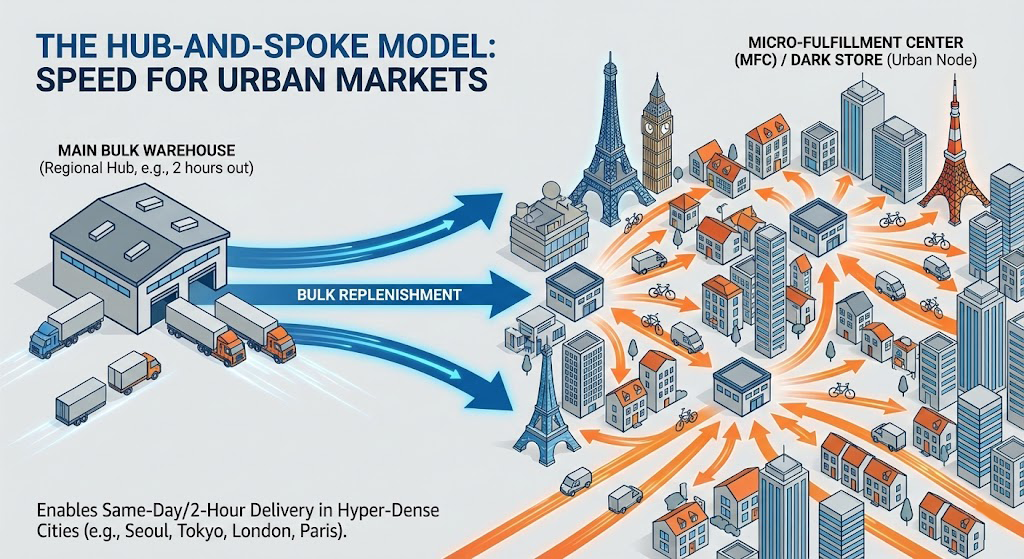

This is driving the trend toward urban “micro-fulfillment centers” (MFCs) or dark stores located inside city limits. These small hubs hold fast-moving SKUs and enable same-day or even 2-hour delivery via bike or van couriers, bypassing traditional carrier networks. Brands operating in hyper-dense cities like Seoul, Tokyo, London, and Paris are increasingly using a “hub-and-spoke” model—a main warehouse for bulk storage that feeds smaller urban nodes for lightning-fast local delivery.

This model is projected to grow rapidly as customer expectations shift toward instant delivery in major metropolitan areas.

Eliminate the Guesswork with ZhenHub

Choosing the right location used to involve expensive consultants and complex spreadsheets. Today, you can access a global network instantly.

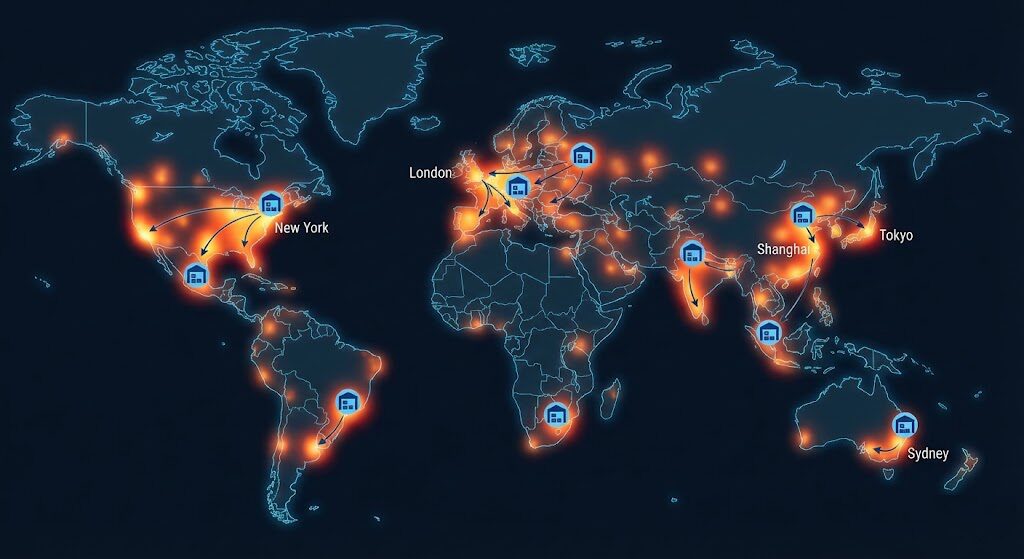

ZhenHub gives you immediate access to a network of strategic fulfillment centers across the US, UK, Europe, Australia, and Asia. Instead of betting your business on a single location, you can distribute your inventory across our global hubs with a few clicks. Our cloud-based dashboard uses your sales data to help you determine exactly where your stock should live to minimize shipping zones and maximize speed.

Ready to optimize your fulfillment strategy? Sign up for free and let our network bring your products closer to your customers.